In this series, we’ve reviewed the development of Black Friday in different countries, and

introduces many shopping festivals around the world. At the very end of this year’s “Black

Friday/

Cyber Monday” shopping frenzy, we observed the transaction data in the US, and we’d share some

insights regarding the online and offline sales during “Black Friday/ Cyber Monday”.

Black Friday, Cyber Monday Sales Hit Another High

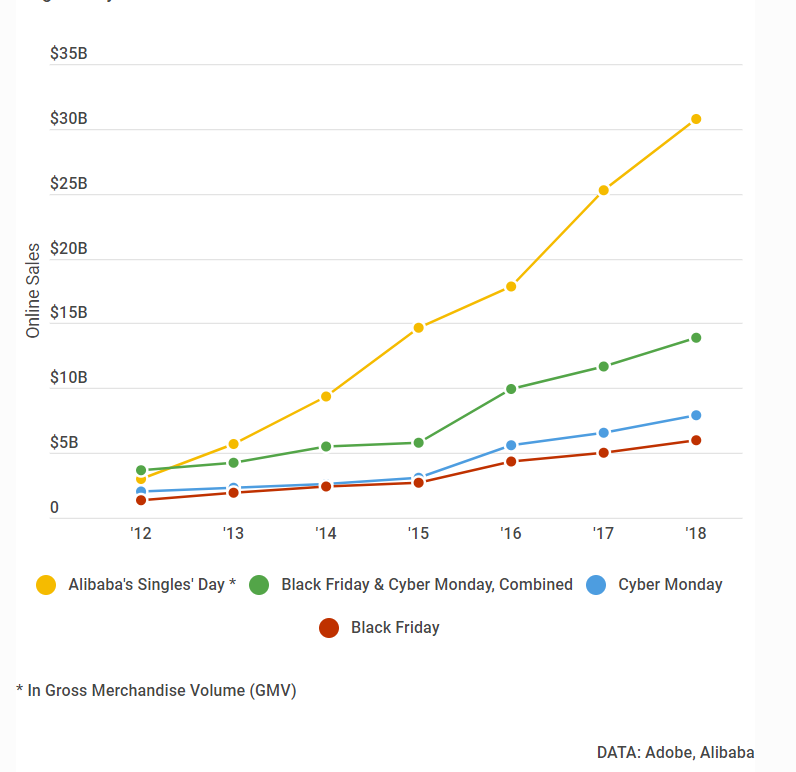

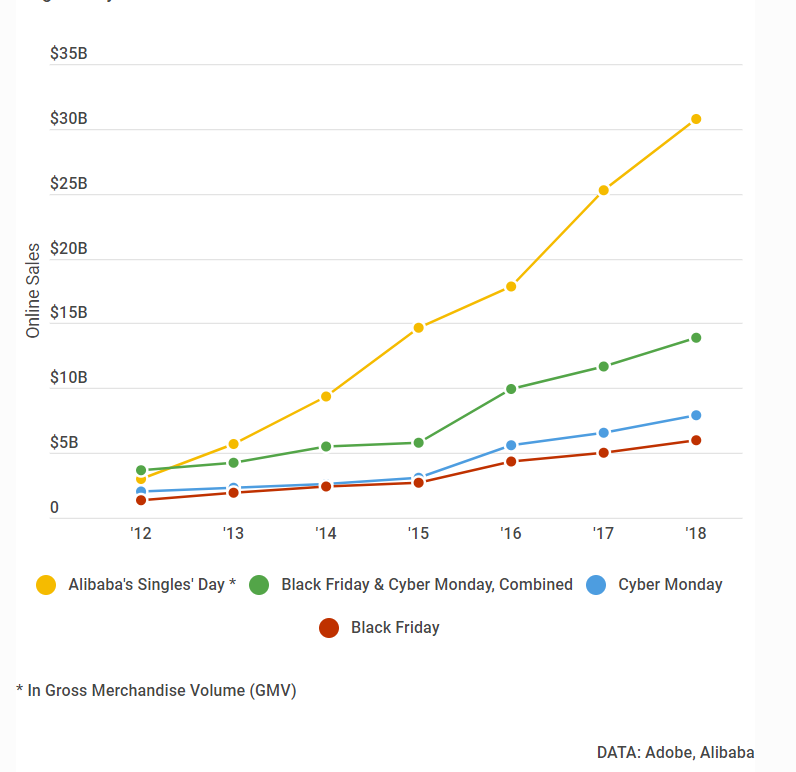

On Cyber Monday, American consumers spent $7.9 billion according to Adobe Analytics. Although

this

number is overshadowed by the record of $30 trillion sales during the Chinese “Double 11”

festival,

it was still the biggest online shopping day in U.S. history.

Online Sales for Different Shopping Days

Online shopping becomes the trend, and retail is negatively impacted Black Friday just isn't

what it

used to be.

Yes, Black Friday, the day after Thanksgiving that signals the traditional start to the holiday

shopping season, is still significant: ShopperTrak still projects it will be the busiest

shopping

day.

But gone are those long lines outside stores like Walmart and Best Buy in the wee hours of

Friday.

In a survey of 60 properties it manages, commercial real estate firm JLL said none of its West

Coast

properties opened on Friday before 5 a.m., with 86% saying they opened shops after 8 a.m. On the

East Coast, only 9% of the shopping centers said they opened before 5 a.m. on Friday.

On the other hand, many consumers have moved more of their budget online. After all, who’d like

to

wait in line with the cold wind and bur the same product for the same price?

Many factors will have an impact on eCPM, such as CTR, CVR, inventory, geolocation, season,

gender,

age, time and etc. Waterfall will help developers fetch the most accurate Placement + Country

data

from different ad platforms. However, the factors that really make a change on eCPM can be

hardly

traced by the Waterfall. For mediation platforms, these factors are in the black box where we

need

algorithm and model to understand and optimize.

Black Friday. Credit: Mirror

RetailNext, which measures store traffic and other data at more than 425 retail brands, said

brick-and-mortar sales on Thanksgiving and Black Friday had dropped by as much as 7% while

traffic

was down 5% to 9%—at least the fourth straight year when both of those measures declined.

With major retailers having moved up store-opening hours to Thanksgiving and extended doorbuster

deals to the web. During 2016-2017, discounted products have nearly doubled online. Meanwhile,

all

the presales campaign, online ads and emails have retargeted consumers over and over during the

whole sales campaign. Consumers can shop for the whole weekend and don’t have to buy exactly on

the

day.

Under such circumstances, more than $2 billion of Monday's sales, or nearly 20% of the day's

total, came from smartphones, after mobile spending topped $2 billion for the first time on

Friday, according to Adobe.

Omni-Channel Retail has Blurred the Line Between Physical and Online Sales

Consumers are smart. They would compare price online and offline to buy the products they want in

the

most decent price. However, retailers are in a race to capitalize on the benefit of both the

online

and brick-and-mortar worlds: While Amazon and other so-called digital native brands are

expanding

their physical footprints—with Amazon partnering with retailers like Kohl’s to process

returns—physical retailers from Walmart to Macy’s are doubling down on their e-commerce spending

and

using their store fleet for such services as online ordering for store or curbside pickup.

Who’s paying for the bill after the bonanza

With retailers including Amazon, Walmart and Target having upped their free-shipping game,

expect

the increased online sales to lead to higher fulfillment and delivery costs.

For instance, Amazon has forecast a disappointing fourth-quarter profit after its Q3 shipping

costs

rose 22% to $6.6 billion, almost double its operating income. Walmart, for its part, has

reported a

narrower Q3 gross margin rate, hurt in part by higher transportation expenses and the increasing

mix

of e-commerce growth. Higher online fulfillment and other supply chain costs also hurt Target’s

Q3

margin.

Sources: Forbes, CNN